unfiled tax returns reddit

In addition to unfiled tax returns many US persons may also have foreign accounts assets and investments that were required to be disclosed on one or more. Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes.

Nj Couple Avoids Fbar Penalty Gets Warning Verni Tax Law

Unfiled tax return preparation is often a central component of income tax controversies and resolution.

. If your return is more than. If you fail to file your taxes by the designated deadline usually April 15 you will be assessed a late filing penalty equal to 5 of the tax due for each month it remains unpaid. These transcripts will help you.

Late Returns Unfiled Taxes James Abbott CPA from jacpaca Irs form 56 to prove you are the executor of the estate. Tax Hardship Center assists you in finding a tax relief program that you qualify for. I tried to get things into a kind of set and forget mode the house is being rented with a property management company rental income is 2500mo before fees mortgage is 1600.

Need help with unfiled tax returns. Complete your tax returns accurately. How Unfiled Taxes Can Haunt You Silver Tax Group from.

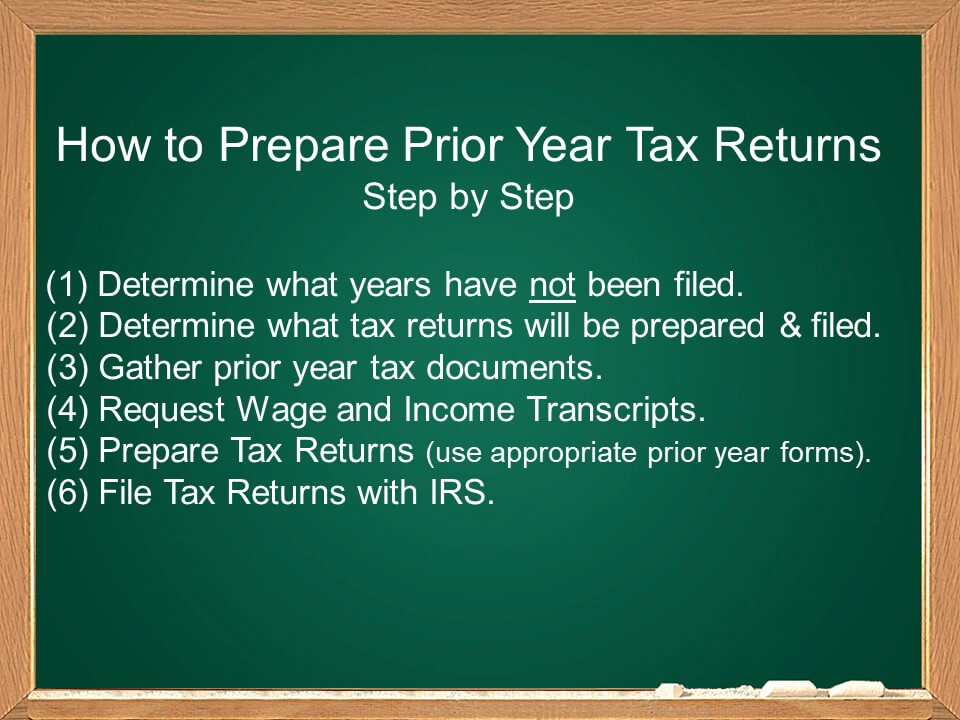

Start by requesting your wage and income transcripts from the IRS. Reddits home for tax geeks and taxpayers. Unfiled Tax Returns Reddit.

While the IRS does not put a bulk of. How to file back tax returns. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD.

Get all the information needed to file the past-due return. You can possibly face imprisonment for a length of time proportional to each year of unfiled tax return. If you need wage and income information to help prepare a past due return complete Form 4506-T Request.

The highest penalty for failing to file is 25. The penalty is typically 5 of the tax payable for each month or portion of a month that the return is late. For the 2021 tax year the federal estate tax.

Call for a free consultation regarding your unfiled tax returns at no cost or obligation. The act of not filing ones tax returns is a crime. Many of our clients seek assistance with filing delinquent or missing tax returns.

The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further. Questions on unfiled tax returns call affordable former irs. You Wont Get Old Refunds.

Unfiled Tax Returns 6 Years.

Irs Notices And Letters Where S My Refund Tax News Information

What To Do If You Have Unfiled Tax Returns Irs Mind

When Does The Irs File A Tax Lien

Forgot To File Taxes In 2013 And Irs Just Notified Me In 2020 R Tax

What Should I Do If I Haven T Filed My Tax Returns In Several Years

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Irs Letter 525 How To Respond Full Guide Silver Tax Group

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Should I Do If I Haven T Filed My Tax Returns In Several Years

Irs Tries To Reassure Pandemic Panicked Taxpayers

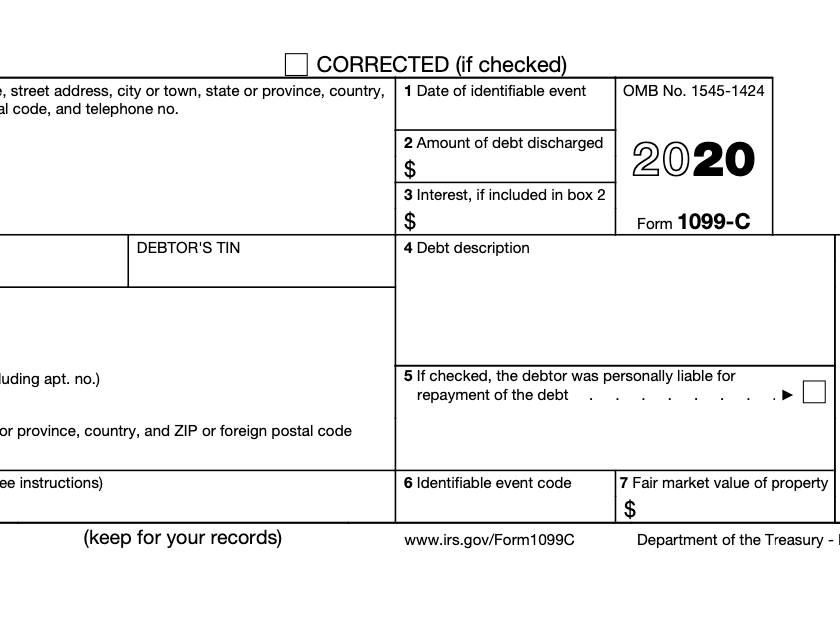

What Does A 1099 C Cancellation Of Debt Mean

Tax Memo Irs To Suspend Most Monthly Collection Letters Until They Reduce Their Backlog Chris Whalen Cpa

Tax Lawyers Can Save Us From Double Taxation Verni Tax Law

Taxes 2020 Audits Are Most Likely To Happen To These Two Groups